A Portfolio Manager's Guide: Private Real Estate

A Portfolio Manager's Guide: Private Real EstateOnce an investor understands an asset class, the next important step before making an investment is to identify how to best integrate it into your overall portfolio. Here, we’ll briefly explore Private Real Estate from a portfolio manager’s perspective.

Consider the most common investment portfolio you can. It’s probably a combination of public equity (stocks) and public fixed income (bonds). Traditionally, investment managers might recommend a 60/40 portfolio of stocks/bonds for a moderate investor. This is often referred to as the 60/40 portfolio.

When thinking about placing money into private real estate, a portfolio manager would evaluate how this new asset class would correlate and perform relative to the rest of the portfolio. As we learned in the Private Real Estate Basics paper, private real estate’s correlation with stocks and bonds is extremely low, so it’s a successful diversifier of returns in a portfolio. Real estate offers potential capital appreciation and growth like equities, while also maintaining rent/income cash flows like bonds. As such, an investor may want to add private real estate as its own asset class, taking a proportionate amount from both equity and fixed income.

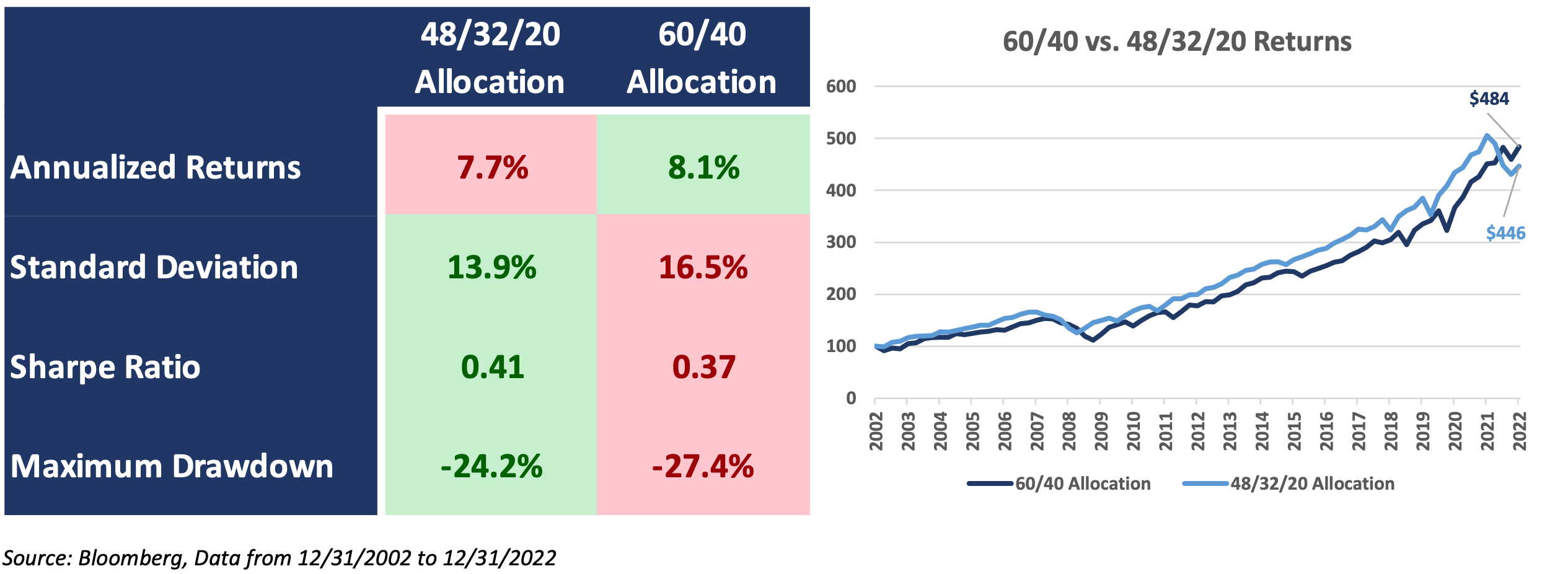

Let’s take a look at the common 60/40 Stocks/Bonds portfolio and compare it to a 48/32/20 Stocks/Bonds/RE portfolio over the last twenty years. We’re only replacing 20% of the model with private real estate, and we’re doing it proportionately out of the original 60/40 mix.

For just a 20% allocation, we were able to make meaningful improvements to the portfolio. While the annual growth rate decreased slightly, the maximum drawdown and volatility were cut. Most importantly from a portfolio manager’s standpoint, the risk adjusted return improved, thus demonstrating Private Real Estate can be beneficial to a fully diversified portfolio.

To take action on this data and consider making an allocation to private real estate, please evaluate our current lineup of real estate strategies or reach out to our team for more customized assistance. For more information around private real estate, please see the Privates School: Private Real Estate educational piece.

Disclosure

This information is for sophisticated investors only who are accredited investors and qualified purchasers.

This material is provided for informational and educational purposes only and is not intended, and may not be relied on in any manner, as legal, tax or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The findings and/or opinions expressed are subject to change without notice. Past performance is not indicative of future results. The findings are not intended to convey any guarantees as to the future performance of the investment products, asset classes or capital markets discussed. Private capital funds are speculative, involve a high degree of risk and are not suitable for all investors. Private capital fund managers have total authority over the private capital funds. Funds of private capital funds are not liquid and require investors to commit to funding capital calls over a period of several years; any default on a capital call may result in substantial penalties and/or legal action. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s objectives will be achieved or that the investors will receive a return of their capital. Reliance upon information in this material is at the sole risk and discretion of the reader. The material was prepared without regard to specific objectives, financial situation or needs of any investor. An investor could lose all or a substantial amount of the investment. Investment advisors and all investors should ensure that they have independently obtained sufficient information to ascertain the legal, financial, tax and regulatory consequences of any investments they consider. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Index Data used in examples:

Private RE: NCREIF Property Index

Public RE: FTSE Nareit Equity REITs Total Return Index

Public Equity: S&P 500 TR Index

Fixed Income: Bloomberg US Aggregate Bond TR Index