Private Real Estate Basics

Private Real Estate BasicsPrivate Real Estate is arguably the most familiar and approachable asset class to those without experience investing in private assets. A significant reason for this is the fact that many investors have experience investing in real estate personally through the purchase of their homes. While there are complex financial models and capital structures taking place in the background, the basic principles are tangible and straight-forward:

Buy or finance the property

Build/improve/maintain the structures and property

Use the property yourself or charge rent

Sell the property (optional)

In some instances, you may not even need the building, just the land itself. Actual real estate investing is far more nuanced, but when you think about real estate through that lens, it’s very approachable.

Investing in real estate is possible in both the public and private markets. Publicly traded real estate investments include Real Estate Investment Trusts (REITs) and Mortgage-Backed Securities (MBS). REITs are an equity investment, owning income-producing real estate. MBS are fixed income or bond investments, secured by real estate loans. REITs and MBS are publicly available for investors, although there are privately traded versions of each as well. Private real estate, similar to public real estate, can take place on the equity side or the debt side of the capital structure. These investments, however, are not publicly listed on exchanges and are not generally available to the public.

Real estate investing requires time, knowledge, financial modeling capabilities, and relationships that most average investors do not have. Most properties are expensive, so for the individual investor, building a diversified real estate portfolio is not feasible on their own. For this reason, most real estate investors utilize professionally managed funds to make their allocations. These funds aggregate the assets of investors to make larger purchases in a portfolio of real estate investments. The fund managers will have the resources, relationships, and knowledge that the investors do not have, while the investors have the capital that the fund managers need.

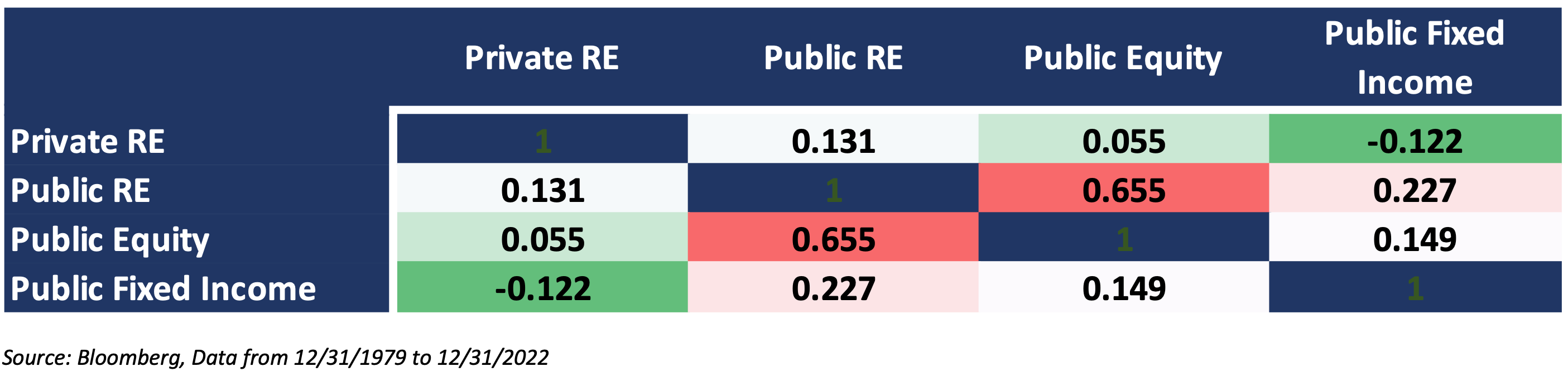

Private Real Estate as an asset class can be hugely additive to a traditional investor’s portfolio, while diversification benefits of publicly traded real estate investments are practically non-existent. The correlation between public REITs and public equities sits at .65, meaning a significant move in equities often creates a significant move in public REITs. Private real estate, however, has only a .06 correlation, meaning a move in public equities has historically had very little impact on the asset class. This is incredibly important from a portfolio management perspective. Adding private real estate adds diversification to a portfolio, adding public real estate does not.

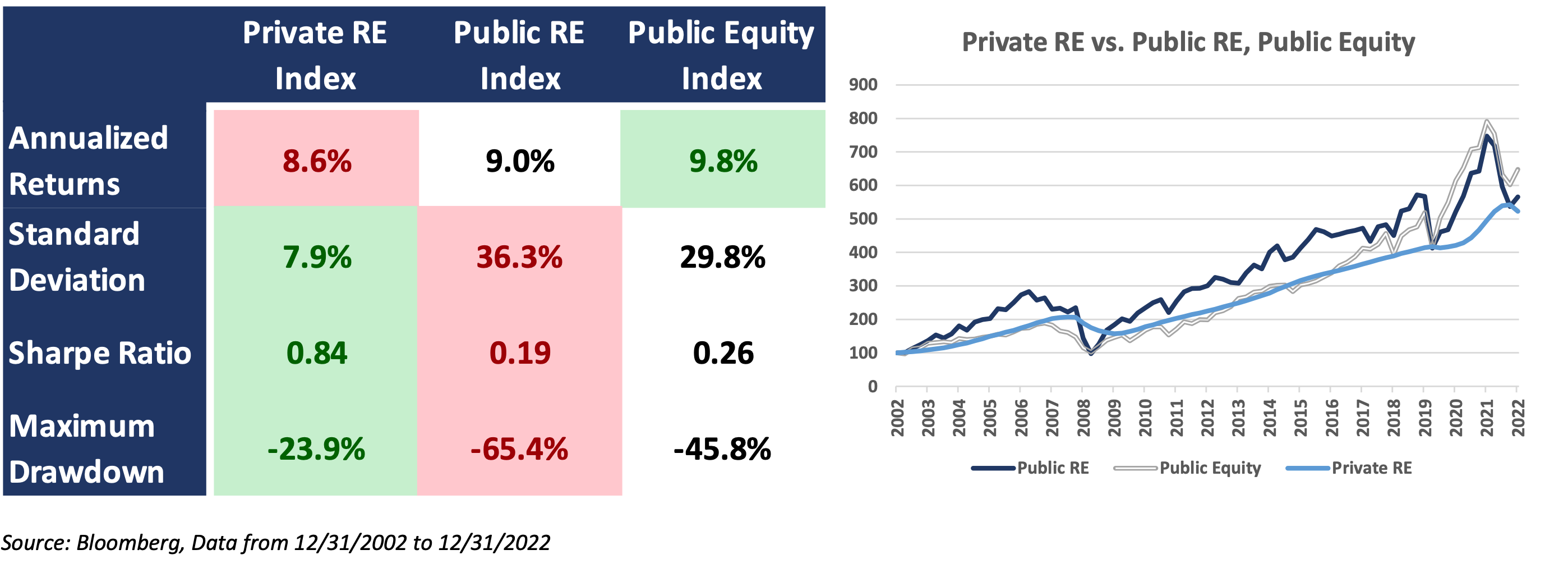

Private real estate benefits aren’t limited to diversification. The total return within private real estate has nearly matched public equities over the last 20 years. Meanwhile, the volatility and drawdown has been less than half.

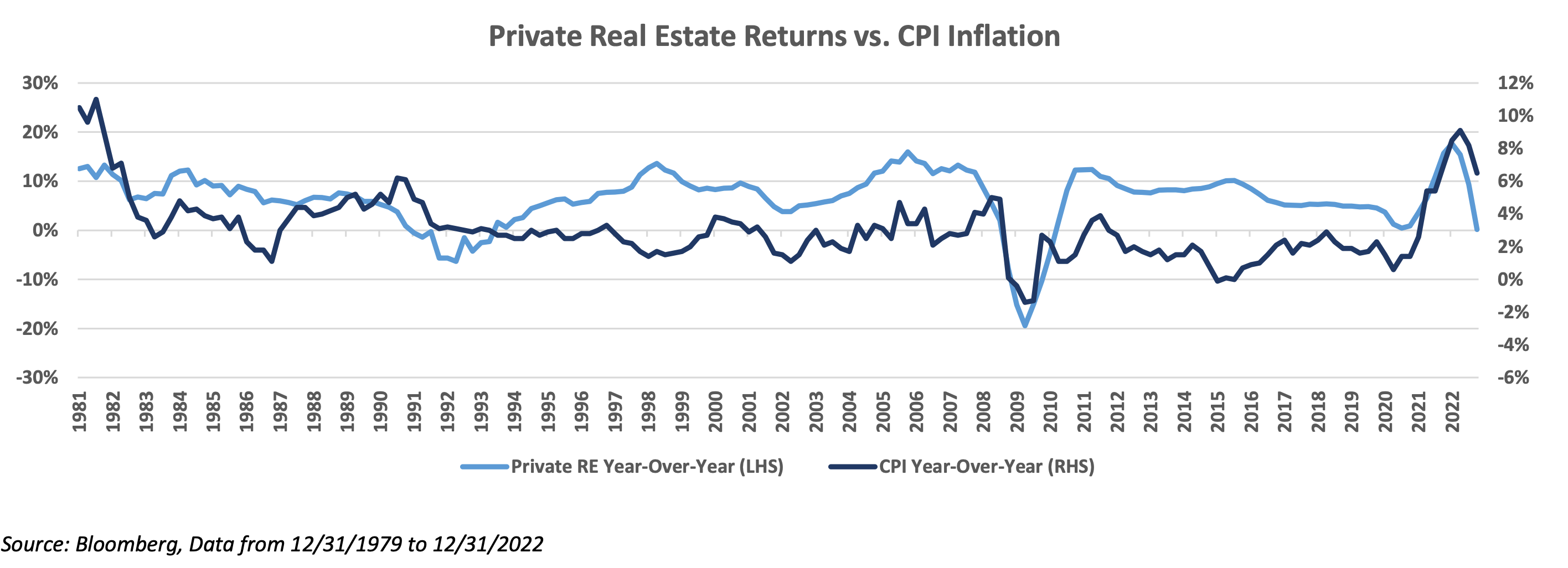

Investors can also benefit from the high collateral value of land, which isn’t nearly as cyclical as the value of companies. Inflation risks are mitigated through a hard asset like property, where the value tends to rise with inflation.

Additionally, the income received from renters on a property creates a cashflow heavy asset, which is extremely beneficial in today’s interest rate environment. On top of all of that, real estate investments can generate tax advantaged income and offset of gains through depreciation. For more information on tax strategies, please see our Privates School piece dedicated to the subject.

Investors often categorize real estate investments by market sizes and growth rates.

Primary markets include major metropolitan areas with large real estate properties and healthy growth rates.

Secondary markets include moderately sized communities and suburban areas of primary markets.

Tertiary markets have smaller populations, smaller real estate projects and less notoriety.

Commercial real estate can be broken down into a few primary sectors, which can have underlying subsectors. These main sectors are:

Office – Buildings used for professional work

Industrial – Warehouses, logistics, and distribution facilities

Multi-Family – Apartment or residential properties with multiple renters in one building

Retail – Shopping centers where consumers come to purchase products

Smaller but growing sectors also include self-storage and data centers, amongst others.

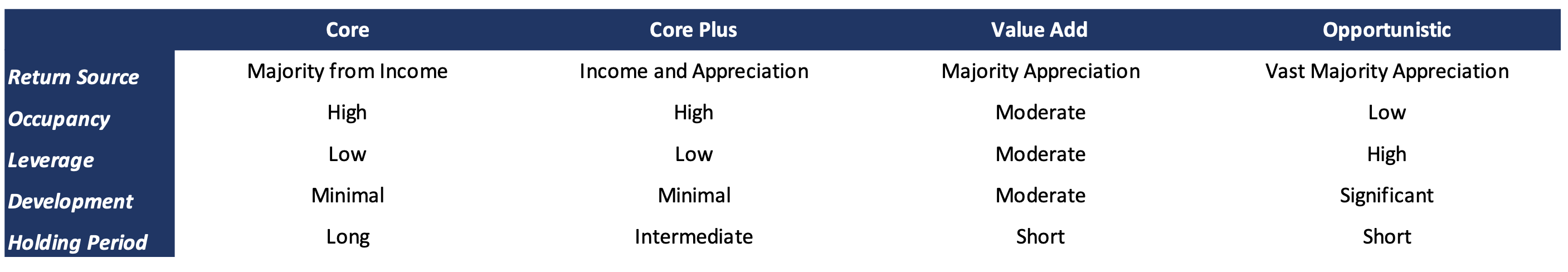

Real estate investments have different styles depending upon the type of property and project. As we move down the scale, the risk and return profiles increase, as does the use of leverage. These investment styles include:

Core – The most conservative profile. High quality assets, in high quality areas, with high levels of occupancy. Lower amounts of leverage used.

Core Plus – Still high-quality assets in high quality areas with high levels of occupancy but may need slight improvements to either the property or occupancy rates to become Core properties. Lower amounts of leverage used.

Value Add – These properties require some improvements. They typically have some tenants and current income but need repositioning and redevelopment in order to maximize returns potential. Higher amounts of leverage used.

Opportunistic – The highest risk and return profile of any real estate investment. These properties may require ground-up development or significant redevelopment of current structures. These investments often have little to no cash flows and will not see a return for years until the value has been added to the property or structure. Leverage may be limited by banks, but oftentimes opportunistic investments use high leverage to fund the costs of development and repositioning.

Manager selection within the private real estate space is incredibly important, as it is within all private assets. In real estate, managers can add value through a multitude of ways. Some of these might include:

Relationships and Deal Sourcing – Private real estate managers use their network to source deals to buy as well as parties to sell to. This provides these managers access to investments and deals that never make it across other investors’ desks. In private real estate, a huge number of transactions occur off-market, where there is no competitive auction. Having access to these deals through network connections can be a differentiator for performance.

Value Creation – Real estate managers can add value to a property through the development or improvement of the land or structures themselves, or through operational efficiencies. A well-run real estate firm with an operations division and property management team should be capable of managing and operating the facilities at a high level, not simply acting as an aggregator.

Fund Structure – The long-term time horizon of a real estate fund helps avoid momentary market volatility, and the closed structure of most of these investments forces investors to avoid liquidating at the worst times. Additionally, using a responsible amount of leverage can help boost returns without adding excessive risk.

Private real estate funds are most commonly structured as a REIT, Delaware Statutory Trust (“DST”), or a limited partnership. In all instances, the investors are passively involved by investing their capital in hopes of achieving a return, while the sponsor or manager oversees the day-to-day operations of the fund.

Private real estate funds can be open-ended or close-ended. Open-ended funds are more common amongst core and core-plus strategies, and typically offer subscriptions monthly or quarterly with at least some amount of liquidity on a quarterly basis. Close-ended funds have a fundraising period, during which investors will commit capital to the fund. Once the close-ended vehicle closes to investors, no new investors or commitments may be made. While terms will change for different close-ended funds, it’s most common to see a 5-7-year fund life. The lifecycle of a fund is fairly straightforward and is made up of three periods.

The fundraising period is the period where the sponsor seeks out investors for the fund. The first close is when the first investors commit to investing in the fund. There may be subsequent closes where additional investors commit. Upon final close, no additional investors may enter the fund.

The investment period for the fund usually occurs during the first couple years of the fund and may overlap with the latter parts of the fundraising period. As the name suggests, the fund will be making investments into properties. During this time, investors will gradually send money to the fund as the investments are made. Depending upon the style of the investment, the fund should start distributions of income.

The harvest period is when the investments are realized. The fund will exit the investments and distribute capital (hopefully gains) to the investors. This process is very gradual. Sometimes an early investment can already harvest gains before the fund is even done making investments. Most exits, however, take longer into the fund’s life. The harvest period ends when the last of the investments is exited and capital is distributed to the investors, at which point the fund has completed its lifecycle.

We hope that this Privates School piece has helped shed some light on the world of private real estate. For those with current exposure to public real estate, we believe a re-allocation of assets to privately traded real estate may improve your risk and return profile. For those without experience in the private real estate space, we believe this asset has a place in most portfolios from an income, diversification, and growth perspective. We’d encourage you to continue to read and learn about the benefits and risks of private real estate. For a better understanding of exactly where to place this asset within the overall portfolio, please see our Portfolio Manager’s Guide to Positioning Private RE Exposure.

This information is for sophisticated investors only who are accredited investors and qualified purchasers.

This material is provided for informational and educational purposes only and is not intended, and may not be relied on in any manner, as legal, tax or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The findings and/or opinions expressed are subject to change without notice. Past performance is not indicative of future results. The findings are not intended to convey any guarantees as to the future performance of the investment products, asset classes or capital markets discussed. Private capital funds are speculative, involve a high degree of risk and are not suitable for all investors. Private capital fund managers have total authority over the private capital funds. Funds of private capital funds are not liquid and require investors to commit to funding capital calls over a period of several years; any default on a capital call may result in substantial penalties and/or legal action. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s objectives will be achieved or that the investors will receive a return of their capital. Reliance upon information in this material is at the sole risk and discretion of the reader. The material was prepared without regard to specific objectives, financial situation or needs of any investor. An investor could lose all or a substantial amount of the investment. Investment advisors and all investors should ensure that they have independently obtained sufficient information to ascertain the legal, financial, tax and regulatory consequences of any investments they consider. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Private RE: NCREIF Property Index

Public RE: FTSE Nareit Equity REITs Total Return Index

Public Equity: S&P 500 TR Index

Fixed Income: Bloomberg US Aggregate Bond TR Index